It's a great tool to use before you shop for a house or before you refinance. Mortgage CalculatorĪ mortgage calculator can help you determine how much house you can afford and estimate your payments. You use the mortgage in addition to your down payment to buy a home. Some lenders also require you to include your real estate taxes and home insurance in the payment.

It includes the principal, interest, and required mortgage insurance. Definitions MortgageĪ mortgage is a loan you borrow to buy a home.

#Buy a house mortgage calculator plus

Your mortgage (principal, interest, real estate taxes, home insurance, and mortgage insurance) plus any existing debts, such as credit cards, car loans, or personal loans shouldn't exceed 43% - 50% of your gross monthly income (income before taxes). Each situation is different but in general, lenders allow up to a 43 – 50% debt-to-income ratio. Lenders determine how much mortgage you can afford based on your income, credit score, and current debts. The mortgage payment is the principal (the portion you'll pay) plus the monthly interest, 1/12th of the real estate taxes, 1/12th of the home insurance, and the required mortgage insurance (if applicable). Multiply that number (your monthly interest rate) by the outstanding principal balance to get your interest charges. You can figure out the monthly amount by taking the annual interest rate (rate quoted) and dividing it by 12. The interest is the fee the bank charges. Your mortgage payment includes principal, interest, mortgage insurance, real estate taxes, and homeowner's insurance. Mortgage insurance helps borrowers secure a loan when they don't have great credit or don't have much money to put down on the home. Government loans, including FHA and USDA loans, charge mortgage insurance for the life of the loan, but at a rate lower than conventional loans. You can cancel it once you pay your balance down to 80% of the home's value. Conventional loans require mortgage insurance if you put down less than 20% on the home. Borrowers pay it, but it is for the lender if you default on the loan. Mortgage insurance is insurance for the lender. The bank then takes the home and sells it to make back the money lost from you not making your payments.

If you default on your payments (usually more than 90 days), they can foreclose on your property. The difference between a mortgage and a standard loan, besides the loan amount, is the collateral. Lenders base your eligibility on your credit score, current debts, money saved, and the home's value. What is a mortgage?Ī mortgage is a loan you take out to buy a home.

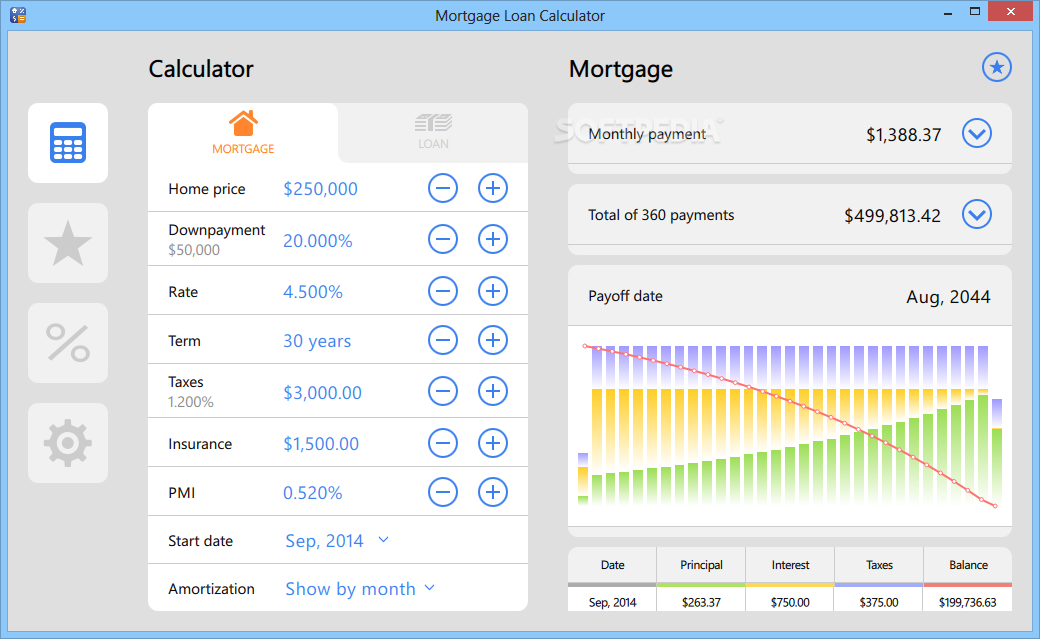

Use our mortgage calculator to see that big picture so you know what you're getting into since a mortgage is a long-term commitment, sometimes as long as 30 years. You can talk to lenders and understand the numbers they throw at you and know what you're comfortable paying each month.īuying a home and taking out a mortgage isn't just about the interest rate – it's about the big picture. It puts you well ahead of the competition. Knowing what you can afford is the first step in buying a home. With our home loan calculator, you can play around with the numbers including the loan amount, down payment, and interest rate to see how different factors affect your payment. Buying a house is the largest investment of your lifetime, and preparation is key. Use our mortgage calculator to help you estimate your monthly payments and what you can afford.

0 kommentar(er)

0 kommentar(er)